is property tax included in mortgage ontario

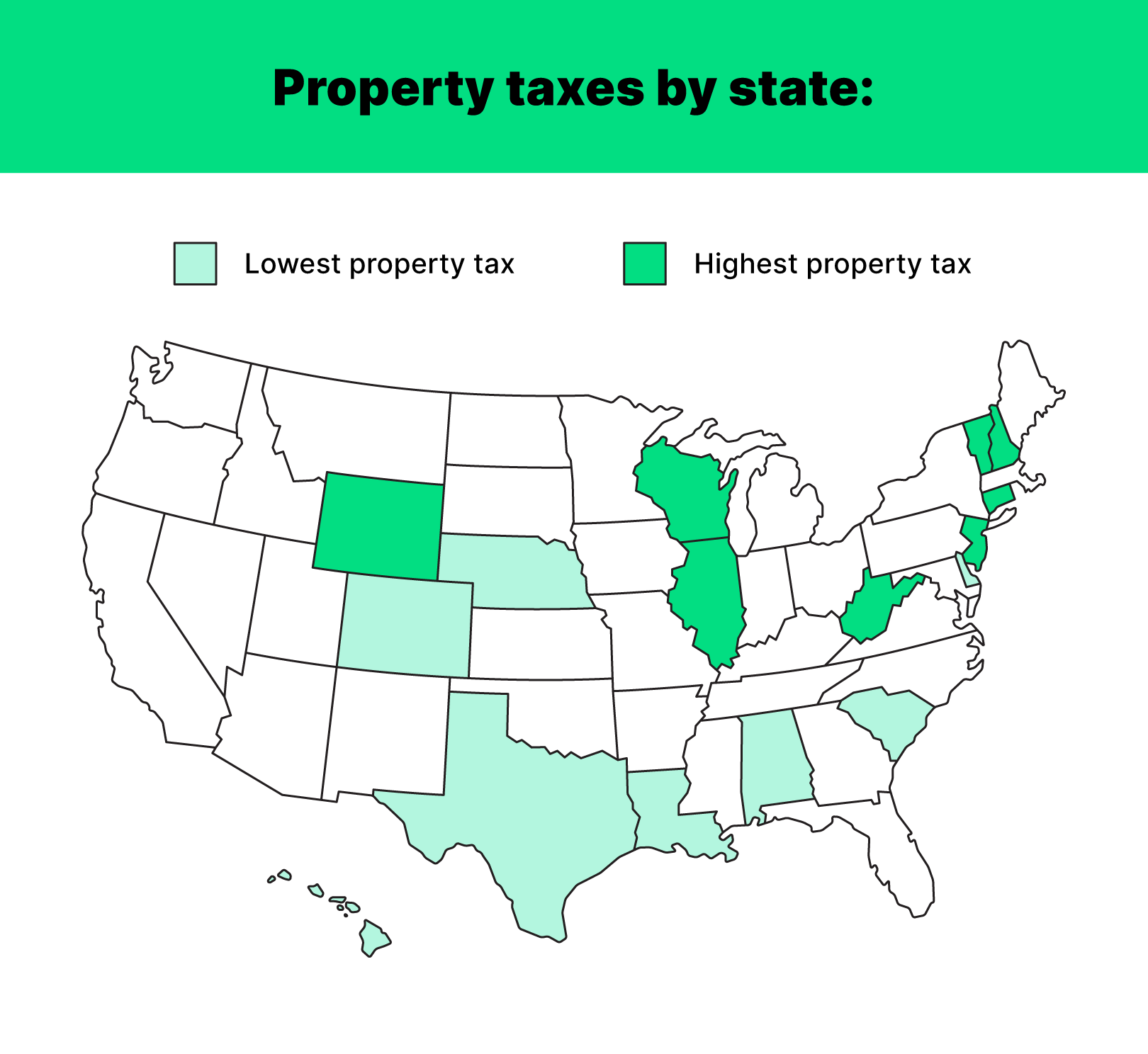

For example a Toronto homeowner with a property valued at 500000 would pay 305507 in property taxes based on the citys rate of 0611013 the lowest on the list. We set the money.

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Lets say your home has an assessed value of 200000.

. To learn more about how you. A municipal portion and an education portion. Ad Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process.

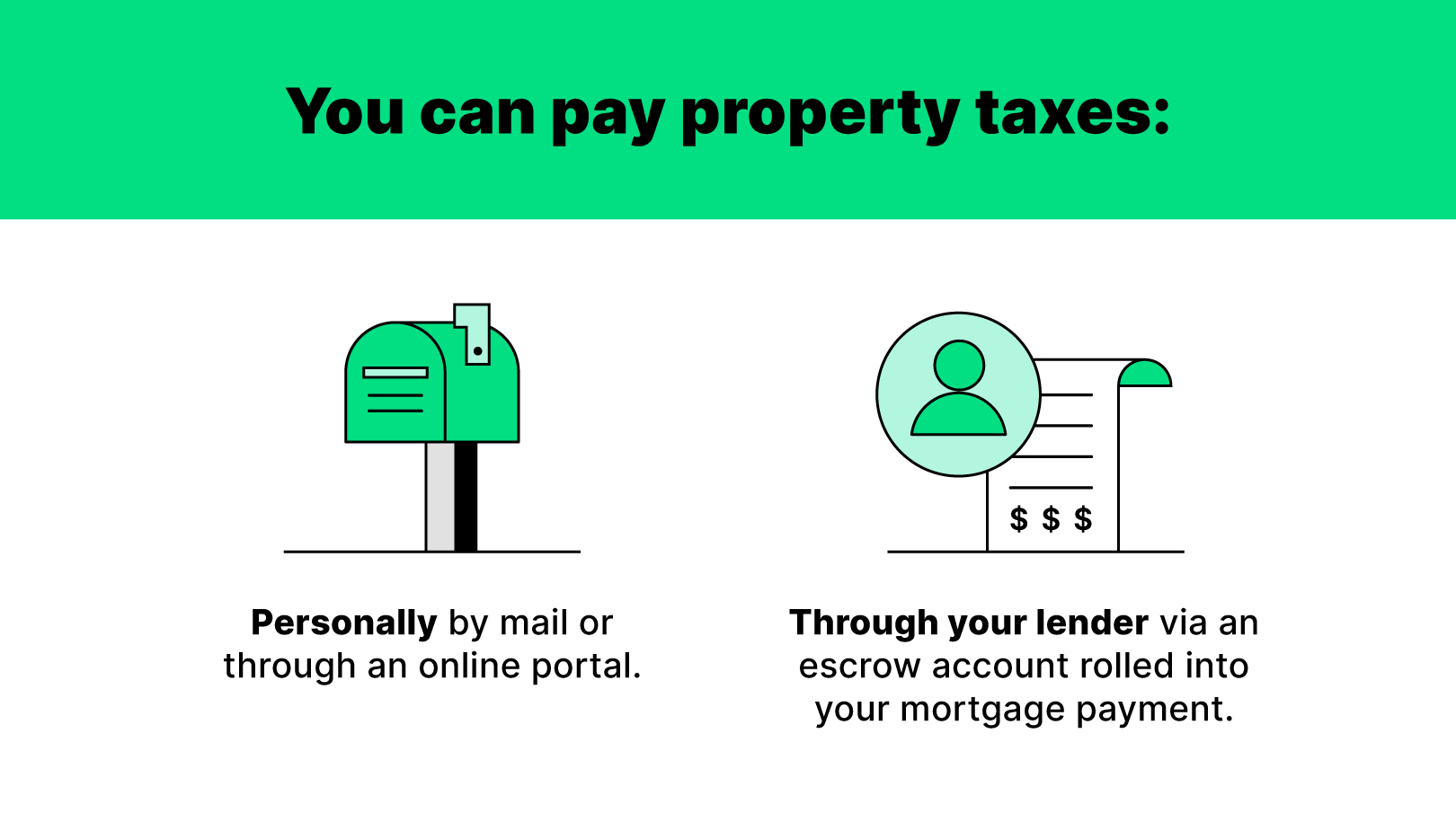

Ad Were Americas Largest Mortgage Lender. When finalizing the mortgage for your new home one of the questions you will have to answer is whether you would like to pay your property taxes through your municipality or if. If they are incurred for the purpose of earning income by renting property to tenants the interest portion of the mortgage is deductible on line 8710 of the T776 Rental.

Ad Get a low rate save on interest and get help from our Mortgage Advisors when you need it. We take a portion of your estimated property taxes along with your regular mortgage payment. Lock Your Mortgage Rate Today.

Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Most condo owners pay condo property tax divided into 12 equal parts included in their monthly mortgage payment.

Generally mortgage interest is only tax-deductible if youre bringing in income from renting out your home or from running your own business. This is greater than revenue. If your county tax rate is 1 your property tax bill will come out to.

Ad Get a low rate save on interest and get help from our Mortgage Advisors when you need it. Were Americas 1 Online Lender. Applying online is quick and easy.

Ad Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. Applying online is quick and easy. Looking For A Mortgage.

In a two-tiered municipality a. When a homebuyer includes the property tax with monthly payments it could mean a changing mortgage amount. MCAP collects the estimated tax amount.

325000 market value of home x 150 property. It will be my primary residence. The new better way to get a mortgage in Canada.

Some lenders also require you to pay your property tax through your mortgage if you are a first-time homebuyer. With tax season around the corner it is a good time to think. The annual principal interest property tax and heat for the property including the secondary suite may or may not have to be used when calculating the debt service ratios.

So our mortgage with BMO includes the property tax component approx 95biweekly payment and this has recently. Revenues from sales taxes such as the HST and RST are expected to total 281 billion or 265 of all of Ontarios taxation revenue during the 2019 fiscal year. Norfolk County Property Tax.

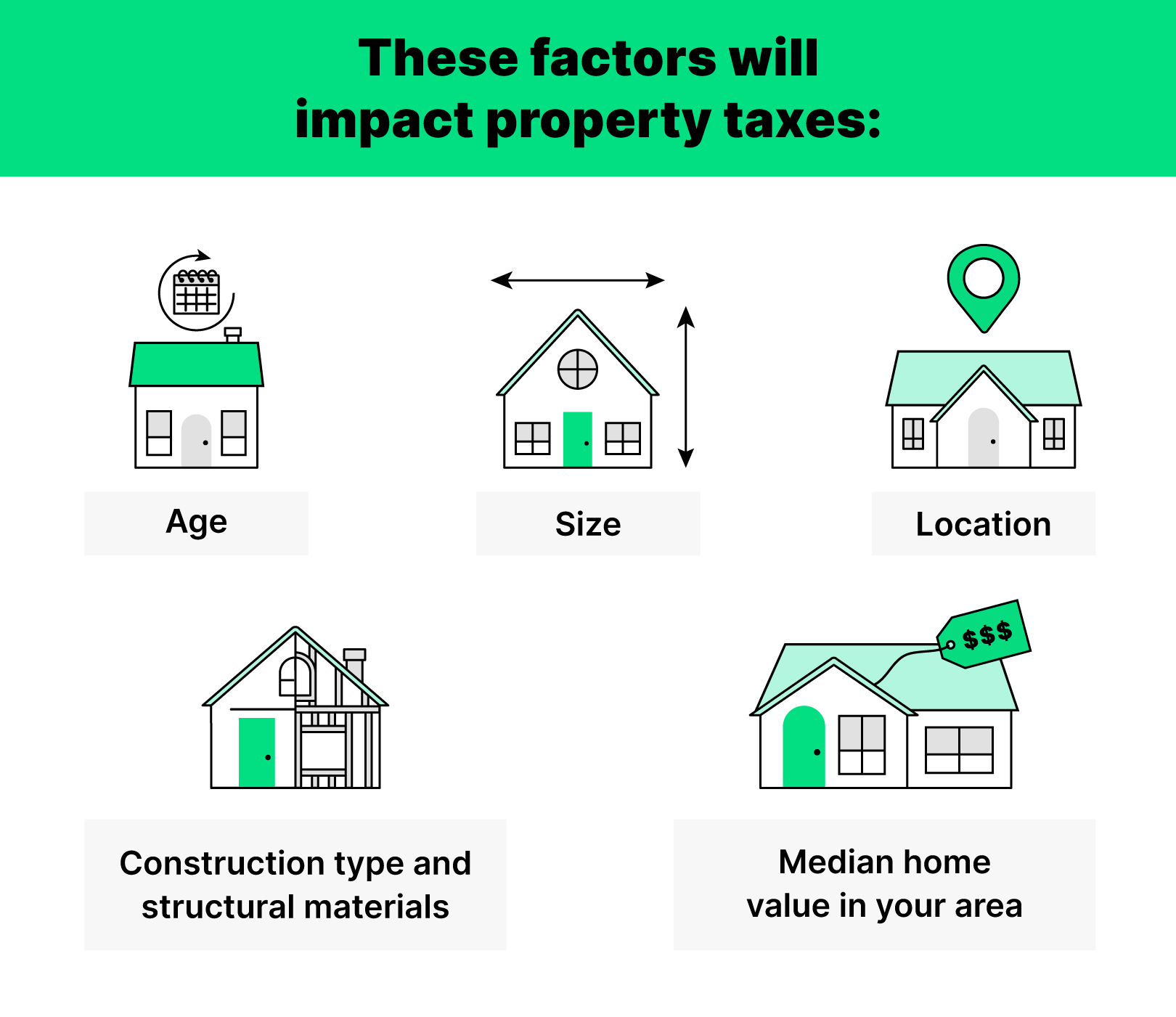

For example if the market value of your home is 325000 and your municipalitys property tax rate is 15 your property taxes would be. The new better way to get a mortgage in Canada. Assessed Value x Property Tax Rate Property Tax.

The rates for the municipal portion of the tax are established by each municipality. The logic behind this decision is that because you are a new homeowner you. The mortgage the homebuyer pays one year can increase the.

Listing price is 439900 and the builder. Im looking into purchasing a new home its already built but I would be buying direct from builder. Its A Match Made In Heaven.

How the Property Tax Service works. Property tax has two components. Hey all been a while since Ive posted but keep reading and learning.

Paying Property Tax In Canada Nerdwallet

Your Guide To Property Taxes Hippo

Should You Pay Property Taxes With Your Mortgage

A Beginner S Guide To Mortgages Beginners Guide Mortgage Mortgage Loans

Land Transfer Tax Calculator A Strong Option To Get Home With Land Transfer Tax Basic Facts Life Facts Home Equity Loan

Property Tax How To Calculate Local Considerations

Paying Property Tax In Canada Nerdwallet

Mortgage The Components Of A Mortgage Payment Wells Fargo

Paying Property Taxes Avoid A Big Bill Options To Make It Easier My Money Coach

Property Taxes By Province In Canada Highest To Lowest

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Idbi Bank Home Loan Offers Flexible Loan Repayment Options And Lower Emis At Attractive Interest Rates Calculate Your E Home Loans Loan Home Improvement Loans

Property Tax Faq Norfolkcounty Ca Working Together With Our Community

Your Guide To Property Taxes Hippo

Do I Have To Pay Property Taxes Through My Mortgage Ratesdotca

Should You Pay Property Taxes Through Your Mortgage Ratehub Ca

Ontario Property Tax Rates Calculator Wowa Ca

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips